Blog

We’d love to meet you to strategize appropriate financial steps to achieve your financial goals

GSCPA Welcomes New Board Member, Cecily VM Welch, CPA

Cecily VM Welch, CPA, is owner of Welch Financial Advisors, LLC. Cecily started her career as an internal auditor at … [Read More...] about GSCPA Welcomes New Board Member, Cecily VM Welch, CPA

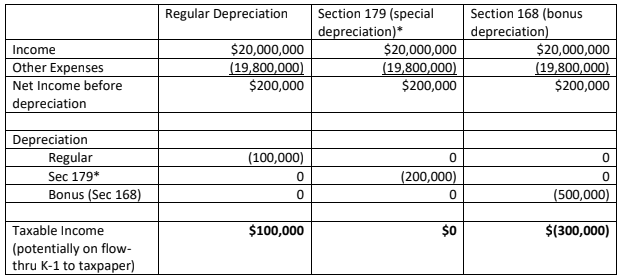

Plain Speak Explanation: DEPRECIATION RULES, I JUST RIGHT IT OFF RIGHT?

From conversations with several business clients, the depreciation rules have gotten so complicated that they just ignore … [Read More...] about Plain Speak Explanation: DEPRECIATION RULES, I JUST RIGHT IT OFF RIGHT?

As you prepare your taxes don’t forget to…

Dear Business Clients, During our time working together, we went over a number of tax-related topics. However, with … [Read More...] about As you prepare your taxes don’t forget to…

Plain Speak Explanation: EMPLOYER CORRESPONDENCE: YOUR PAYCHECK IS CHANGING

Did your employer recently notify that your next paycheck will be updated? And now are you thinking, “Wait, but I didn’t tell … [Read More...] about Plain Speak Explanation: EMPLOYER CORRESPONDENCE: YOUR PAYCHECK IS CHANGING

In The Media

Spring Cleaning: Get Your Finances in Order

It’s an iconic image of American small business — a shoebox filled with receipts and sales records, handed off each spring to an accountant who then translates the contents into a coherent tax return. Iconic, perhaps, but also passé.

Marrying after 50? Tackle these money issues first

When accountant Richard Grebinger connected with teacher Cindy Lambert on the dating website eHarmony in February 2011, they “knew instantly that we wanted to be together,” he says—and indeed, they were married last July. But while love may have felt simple for the two 54-year-olds, the financial part of their relationship was less cut and dried.

Can I borrow a personal loan to invest money?

Since not everyone has the money needed to contribute to worthwhile investments, such as stocks, it seems reasonable that some prospective investors would turn to borrowing money to fund their investing plans. But borrowing money to potentially make money is not always a wise decision, especially for the average or novice investor.